2,00,000Ĭost of stay aboard of the employee or any member of the family for medical treatment and cost of stay of one attendant who accompanies the patient in connection with such treatmentĮxpenditure shall be excluded from the perquisites only to the extent permitted by RBI.

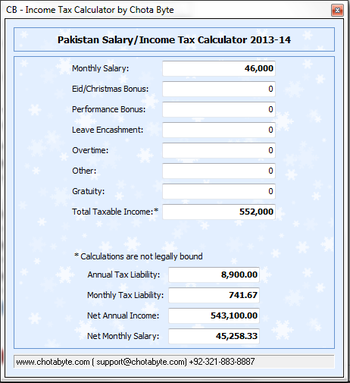

Medical treatment of employee or any member of family of such employee outside IndiaĮxpenditure shall be excluded from perquisites only to the extent permitted by RBI.Ĭost of travel of the employee or any member of his family or any one attendant who accompanies the patient in connection with treatment outside IndiaĮxpenditure shall be excluded from perquisites only in the case of an employee whose gross total income as computed before including therein the expenditure on travelling does not exceed Rs. Note: Fixed medical allowance given by employer to employee is fully chargeable to tax.Įxpenditure incurred by the employer on medical treatment of employee is taxable subject to the conditions given below:- Perquisites not chargeable to tax 15000 per assessment year (This exemption is not applicable from A.Y 2019-20) Medical insurance premium paid or reimbursed by employer Not chargeable to tax with no monetary cellingįor treatment of prescribed diseases given in Rule 3A(2) You may well have to do some sifting to find precisely what you need.Treatment of medical facility provided by the employer to employee is as follows: The IRS website search function is useful, but as with government sites, it returns a lot of information. The IRS provides a comprehensive Tax Topic Index covering the major tax questions. Double-check local tax specifics using the FindLaw State Tax Law finder. The same is true for student loan payments and interest, and so on.Īlso, individual states have specific tax laws. If you contribute to a Roth IRA, for instance, you need to know the specific contribution limit for your tax status: IRS Roth IRA Limits. However, these only cover tax reforms and structures. As a quick example, you can use VLOOKUP to find and return values in a tax table, while you can use ISPMT to calculate the amount of interest paid on your outstanding loans.Īlso, handy for building your own income tax calculator spreadsheet is the IRS 1040 Tax and Earned Income Credit Tables. Read more about what these Excel formulas do and how to use them properly.

0 kommentar(er)

0 kommentar(er)